2024 Instructions To Irs Form 1065, Schedule K

2024 Instructions To Irs Form 1065, Schedule K – How to Unlock an iPad without Apple ID-iOS17 Support Send2Press Newswire . If you are looking to get on track to becoming a 401(k) millionaire or achieving financial freedom, the IRS has just announced the new 2024 401(k) contribution limits. For those with a 401(k), 403 .

2024 Instructions To Irs Form 1065, Schedule K

Source : www.irs.gov

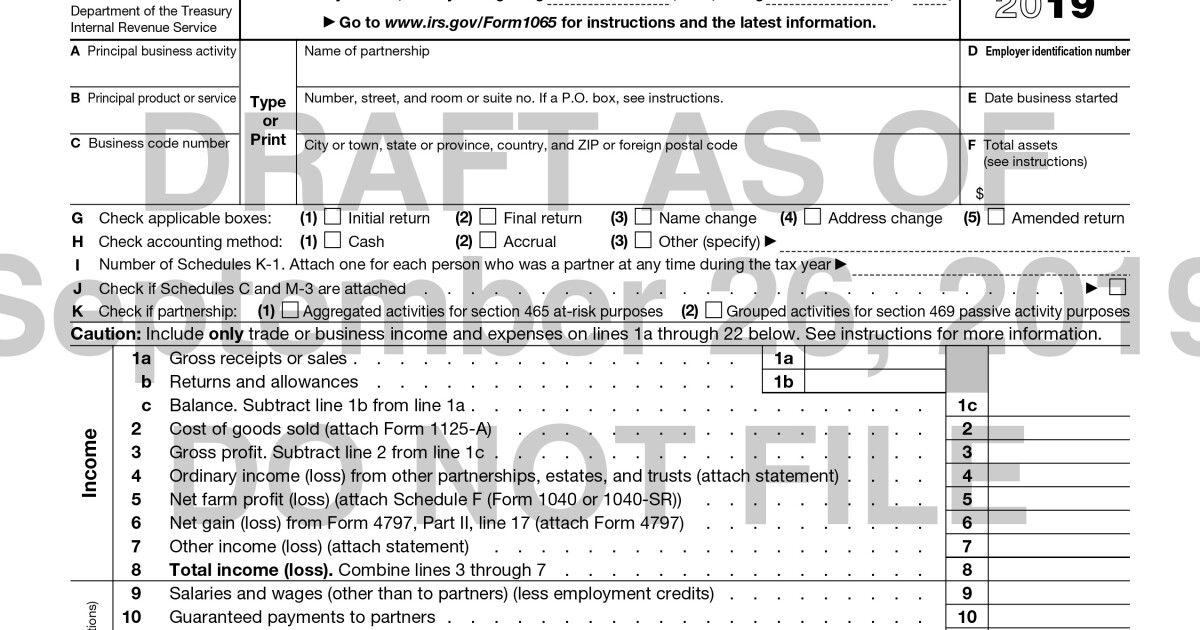

IRS releases drafts of the new Form 1065, Schedule K 1

Source : www.accountingtoday.com

Laredo College on X: “Need further guidance on how to complete

Source : twitter.com

3.11.15 Return of Partnership Income | Internal Revenue Service

Source : www.irs.gov

IRS releases drafts of the new Form 1065, Schedule K 1

Source : www.accountingtoday.com

3.11.15 Return of Partnership Income | Internal Revenue Service

Source : www.irs.gov

Form 1065: U.S. Return of Partnership Income—Definition, Filing

Source : www.investopedia.com

3.11.15 Return of Partnership Income | Internal Revenue Service

Source : www.irs.gov

2022 IRS Form 1065 Walkthrough | Partnership Tax Return YouTube

Source : m.youtube.com

3.11.15 Return of Partnership Income | Internal Revenue Service

Source : www.irs.gov

2024 Instructions To Irs Form 1065, Schedule K 3.0.101 Schedule K 1 Processing | Internal Revenue Service: the catch-up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), most 457 plans, and the Thrift Savings Plan remains $7,500 for 2024, according to the IRS. . In response to inflation, the IRS has announced an increase in the 401(k) contribution limit for 2024, allowing workers to save more for retirement. Starting next year, individuals can contribute .

:max_bytes(150000):strip_icc()/Form1065-55a61388dd91421d8736a94d3b20f03e.jpg)