Schedule C Irs 2024 Form

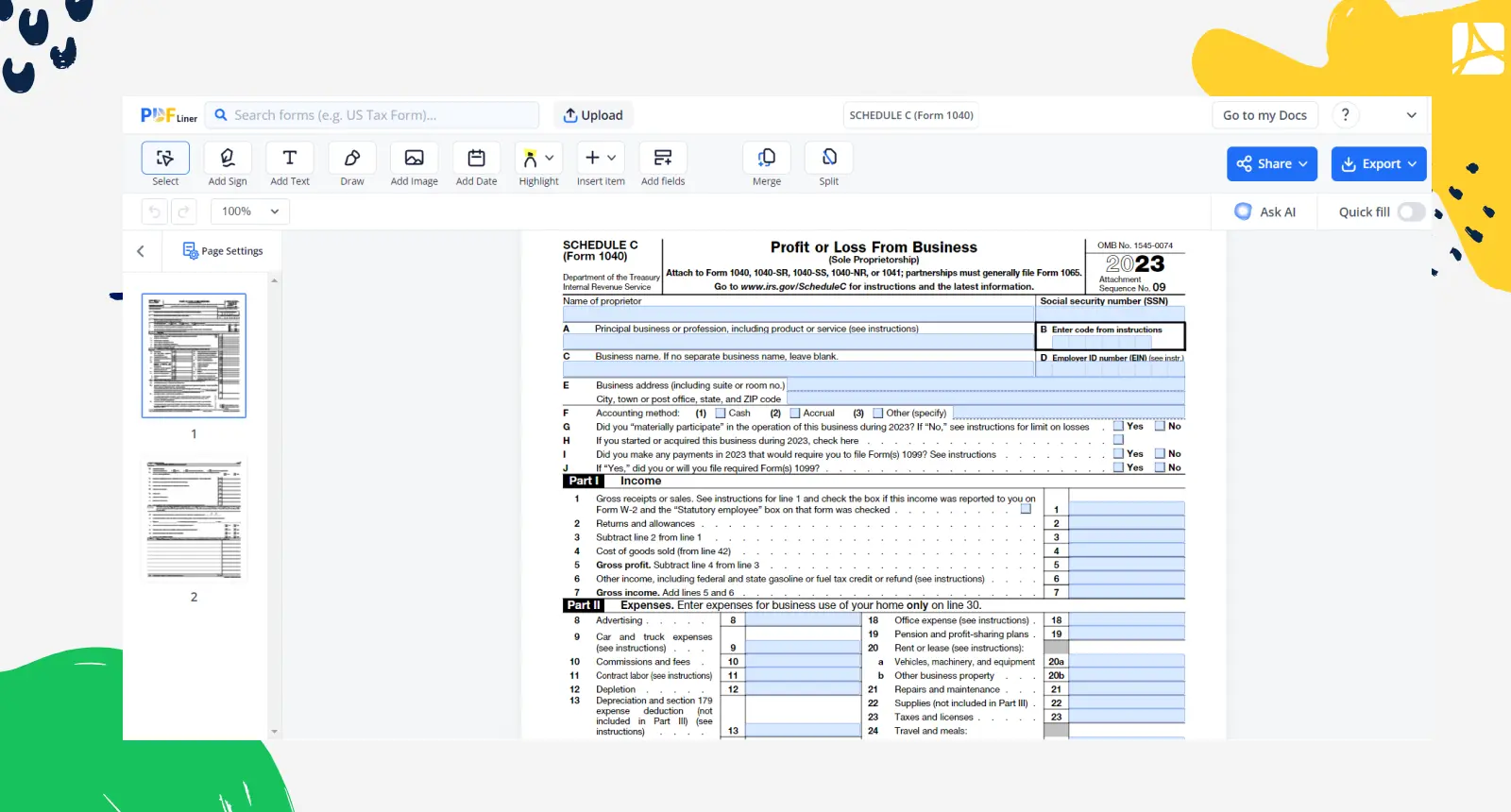

Schedule C Irs 2024 Form – Some gifts that a small business owner gives to their employees may be taxable, while others are not. Here’s how to know the difference and understand record-keeping requirements and best practices. . You do so on a tax form called Schedule C. See Insider’s picks for the best tax software >> Here’s what to know about Schedule C and its filing requirements. Schedule C is a form that self .

Schedule C Irs 2024 Form

Source : carta.com

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Property Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com

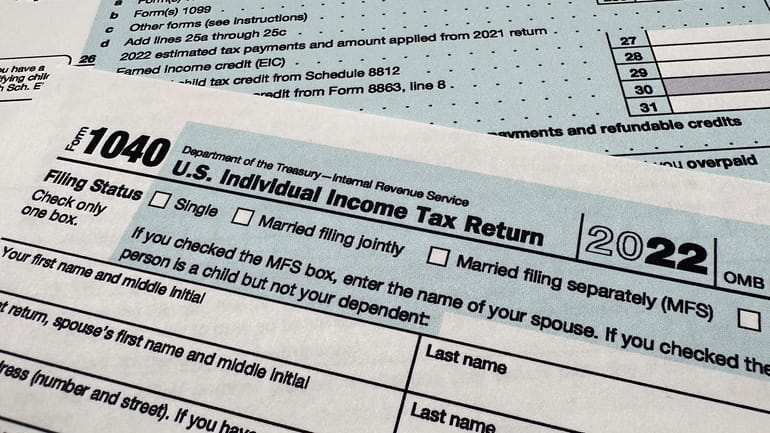

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

Tax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.com

3.11.10 Revenue Receipts | Internal Revenue Service

Source : www.irs.gov

Taxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.com

BSB Associates | Hauppauge NY

Source : www.facebook.com

IRS moves forward with free e filing system in pilot program to

Source : www.newsday.com

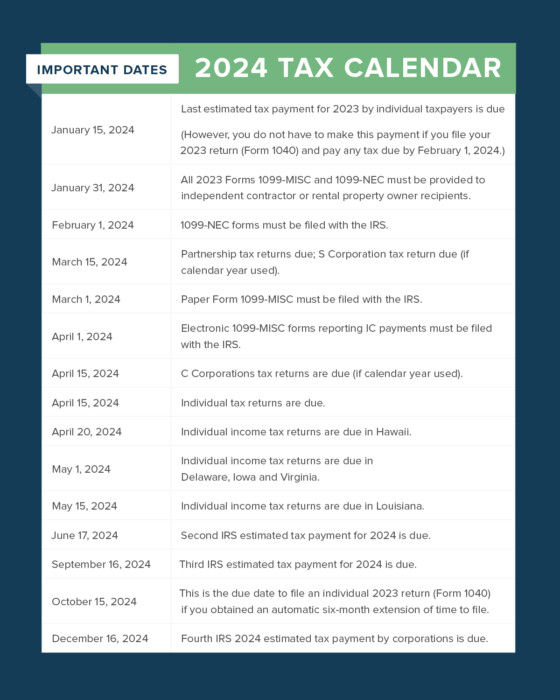

Schedule C Irs 2024 Form Business tax deadlines 2024: Corporations and LLCs | Carta: The information on that document can help you to fill out Schedule E (or C). Schedule a flat rate of $50 in 2024, credit score tracking, personalized recommendations, timely alerts, and more. . Note that the provided schedule is approximate, and changes may occur. Any modifications will be promptly communicated through the Commission’s website. Regular updates regarding the estimated .